Documents Everywhere. Progress Nowhere.

Invoices, bills of lading, airway bills, packing slips—buried in manual chaos that stalls claims for weeks.

File complete, audit-ready duty drawback claims in a fraction of the time. Every claim is validated against compliance rules, so you reduce risk, avoid costly errors, and accelerate refunds with confidence.

Turn duty drawback into a real-time refund engine—fast, compliant, and backlog-free.

Invoices, bills of lading, airway bills, packing slips—buried in manual chaos that stalls claims for weeks.

Every delay compounds—cash tied up, refunds lost, opportunity gone. Every missed refund is profit left behind.

The small claims you skip are the biggest leak in your recovery strategy. Thousands of overlooked refunds quietly erode your bottom line every year.

Disconnected systems and manual spreadsheets turn recoveries into roadblocks. When every link in the chain is manual, cash flow stalls.

Drop in your files or sync your DMS—Campfire instantly recognizes, classifies, and cleans your data for action.

AI enforces accuracy by automatically verifying codes, quantities, and connections—eliminating human guesswork.

Automate ACE-ready exports, compile digital evidence, and hand off seamlessly to brokers or CBP.

Spreadsheets and emails weren’t built for speed, scale, or accuracy. Automation is rewriting the rules — and manual processes are losing fast.

Trapped cash flow – Refunds expire, claims slip through the cracks, and untapped recoveries stay buried in spreadsheets.

Process drag – Disconnected brokers, manual data entry, and file chaos stall every refund.

Audit exposure – Outdated workflows invite costly errors, compliance risk, and sleepless nights.

Unlock millions in duty drawback through intelligent automation that eliminates bottlenecks, clears backlogs, and ensures every claim is audit-ready—before it expires.

Accelerate Cash Recovery – AI-driven workflows reclaim refunds in record time—recovering multi-year backlogs before deadlines hit.

Maximize Every Dollar – Capture the full spectrum of refunds—from major claims to micro-recoveries often left unfiled.

Eliminate Risk Exposure – Smart validation instantly flags errors, duplicates, and compliance gaps—so you file with confidence.

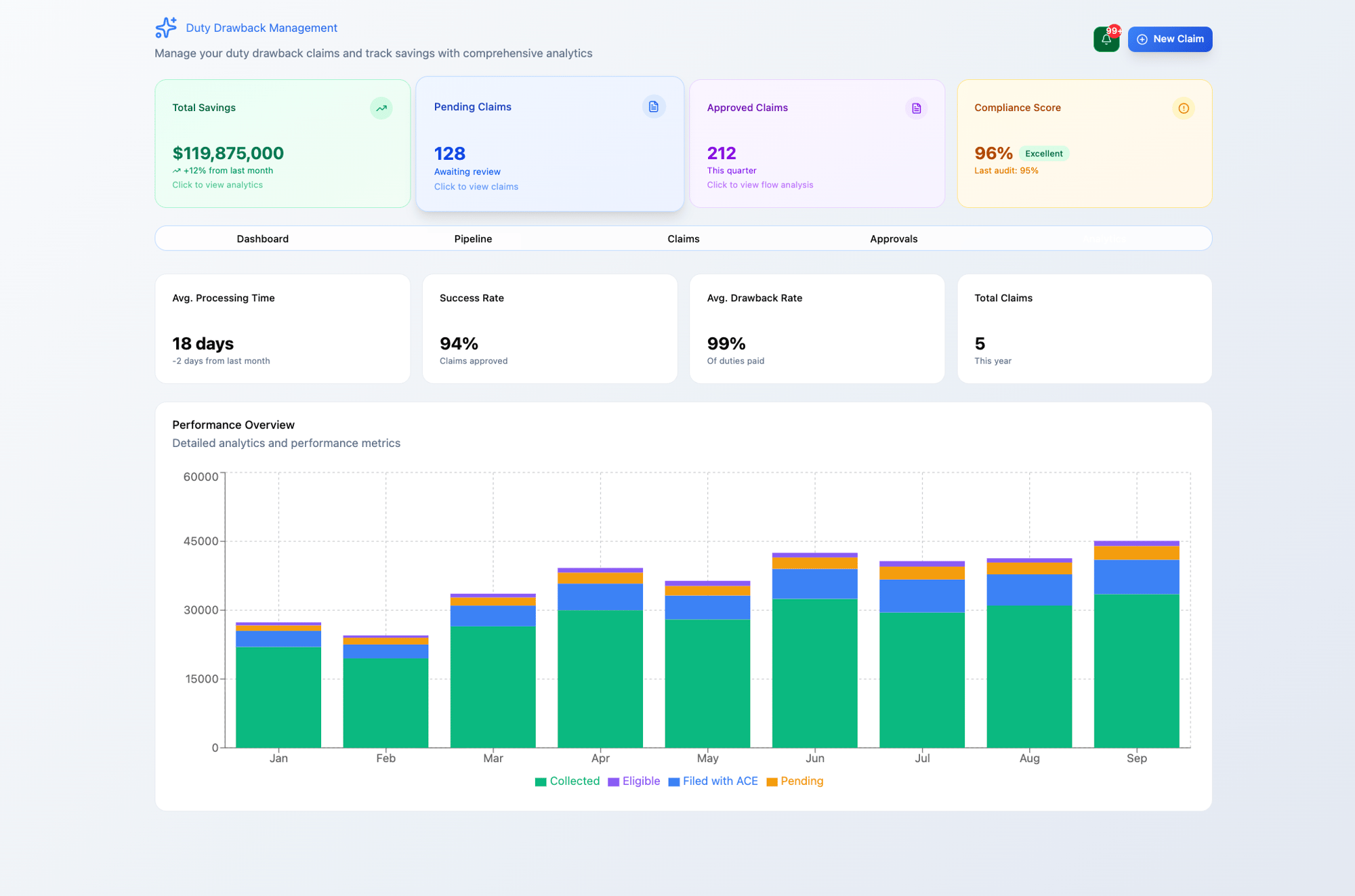

Quantify the Impact - Live dashboards track refund velocity, backlog burn-down, and total cash unlocked—proving ROI with clarity.

"Having implemented and leveraged Campfire at other companies, I have firsthand experience with the functionality of Campfire and the team’s knowledge of the automotive business. We look forward to benefitting from the power of Campfire’s digital financial backbone."

“When it comes to opportunity management and sales forecasting, I have recommended Campfire Interactive to at least 10 companies over my career, including some of the largest Tier 1 automotive customer suppliers in the world.”

“I like the visibility of global opportunities. Prior to using Campfire Interactive, we would conduct Excel-based reporting and sales meetings with everyone bringing their information. Now, we can check it daily, look at the reports daily, and see what is coming into the system and what needs to be managed.".”

Campfire connects every profit lever—quoting, forecasting, margin intelligence, and refund recovery—so finance and operations can see, act, and win in real time.

Turn months of manual work into days—capturing every eligible refund, accelerating cash recovery, and reducing costly errors..

Connect your drawback process end-to-end with ACE-ready outputs, direct integrations, and enterprise-grade security that keeps every claim compliant and audit-ready.